One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list.

Think of it like this. Your wish list and your budget are the guardrails of your search. And when your budget needs to hold firm, there’s another lever you can pull. That’s seeing if you truly need all of your desired features. Because the truth is, a small compromise could be the difference between feeling stuck and getting the keys to your next home.

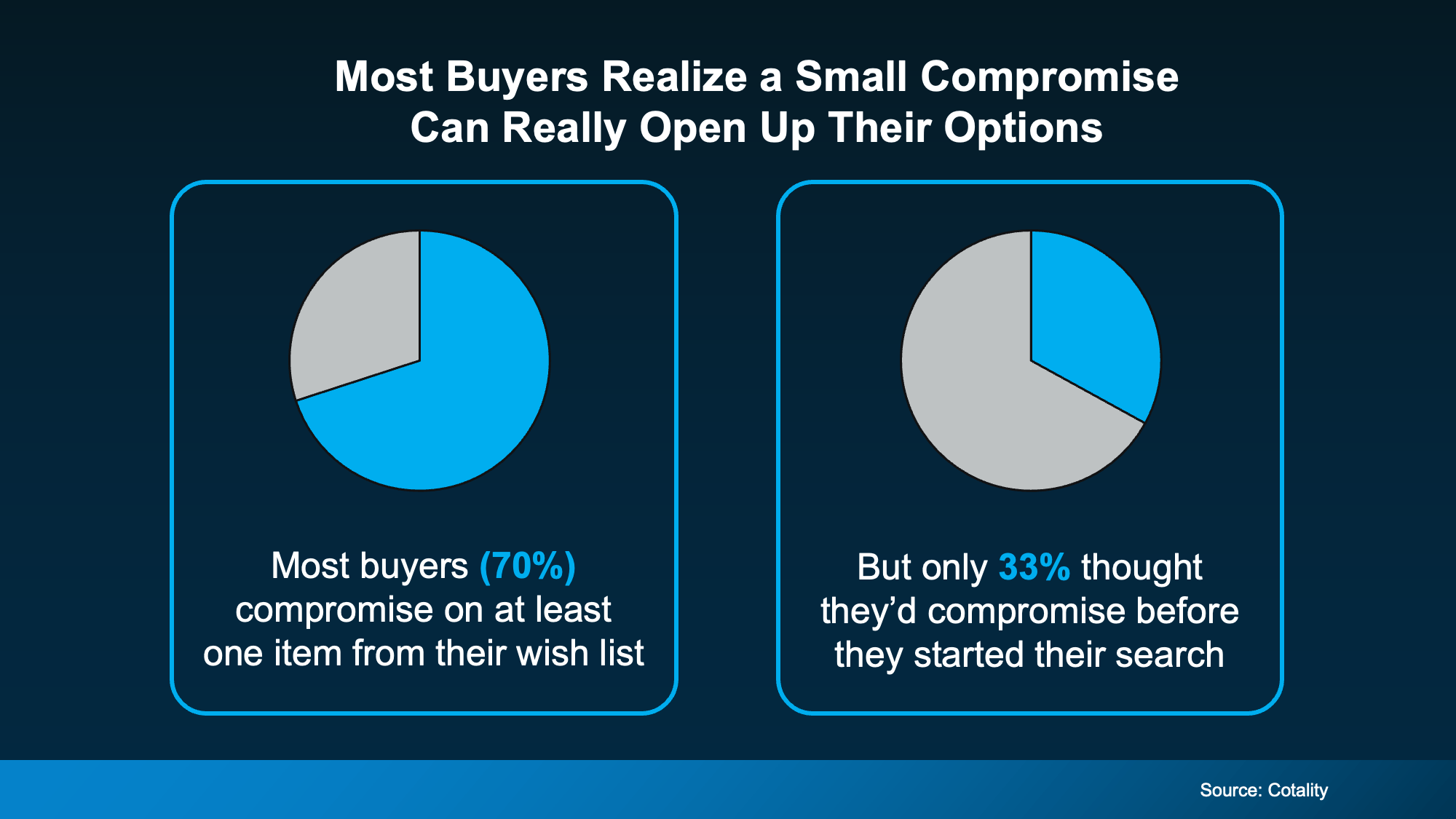

The data shows more buyers are using that strategy to offset affordability hurdles in today’s market. A recent study from Cotality found most buyers (70%) ended up compromising on one or more items from their original wish list. But before they started searching, only 33% expected to compromise at all:

What changed? They realized something during the search. The things you can’t change matter far more than the things you can update later.

What changed? They realized something during the search. The things you can’t change matter far more than the things you can update later.

You can:

- Install hardwood floors

- Put in those marble countertops

- Upgrade the bathrooms down the line.

You can’t as easily:

- Add land

- Tack on more bedrooms or bathrooms

- Move the house closer to people you care about

In the end, things like the location, layout, and overall bones matter far more than the cosmetic features you can change later. And that realization is power.

A Simple Step That’ll Open More Doors

So, if you’re hitting a wall in your search or you’re browsing online and just not seeing “it,” here’s an easy exercise that can reset the whole experience. Write down everything you want in a home, then sort it into three buckets:

- Must-Haves: Your non-negotiables. The things that make daily life workable: the number of bedrooms, the length of your commute, accessibility, safety, or being close to your family or support system.

- Nice-to-Haves: Features you’d absolutely enjoy but aren’t truly essential. Some examples: a fenced-in backyard, dual closets in the owner’s suite, or a stamped patio.

- Dream Features: The extras that would truly be over the top. They’re the things you think about when you say “one day, I want to have…” It’s great if you get them, but totally fine if you don’t (for now).

Once you divide your list, you’ll notice something. Your wish list can either limit your options or open them up.

Sometimes you’re treating “nice-to-haves” like “must-haves.” Loosen that up even a little, and suddenly more homes come into range – including homes you may have scrolled past that could actually work for your lifestyle.

Small Flexibility, Big Payoff

Your next home doesn’t need to check every box. It just needs to check the right ones.

Maybe that means considering a house that needs light cosmetic updates. Maybe it means choosing a slightly smaller yard for a better location.

These aren’t sacrifices. They’re worthwhile trade-offs that get you into a home. Just remember, anything cosmetic can be upgraded over time. But getting the right bones, the right layout, the right location? That’s what sets you up for the long run.

An Agent Helps You See the Possibilities

If you’re not sure what to hold firm on and where you can flex, that’s where a trusted agent can be a game changer. They’ll help you spot the opportunities, walk you through what features you truly shouldn’t budge on, and determine which ones you can add later – when the time is right.

Bottom Line

If you’re ready to find a home that fits both your budget and your life, let’s take a look at your wish list together. With a local expert on your side, it’s easier to see where a little flexibility can open up a lot more opportunity.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

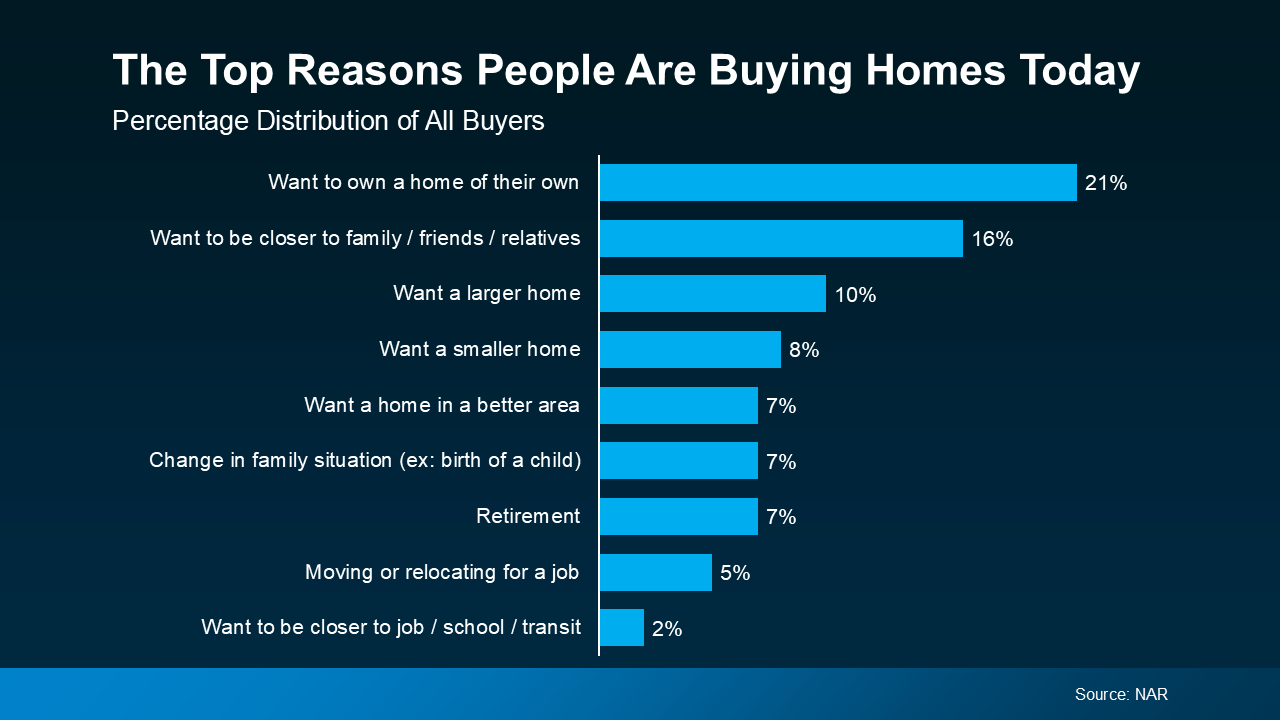

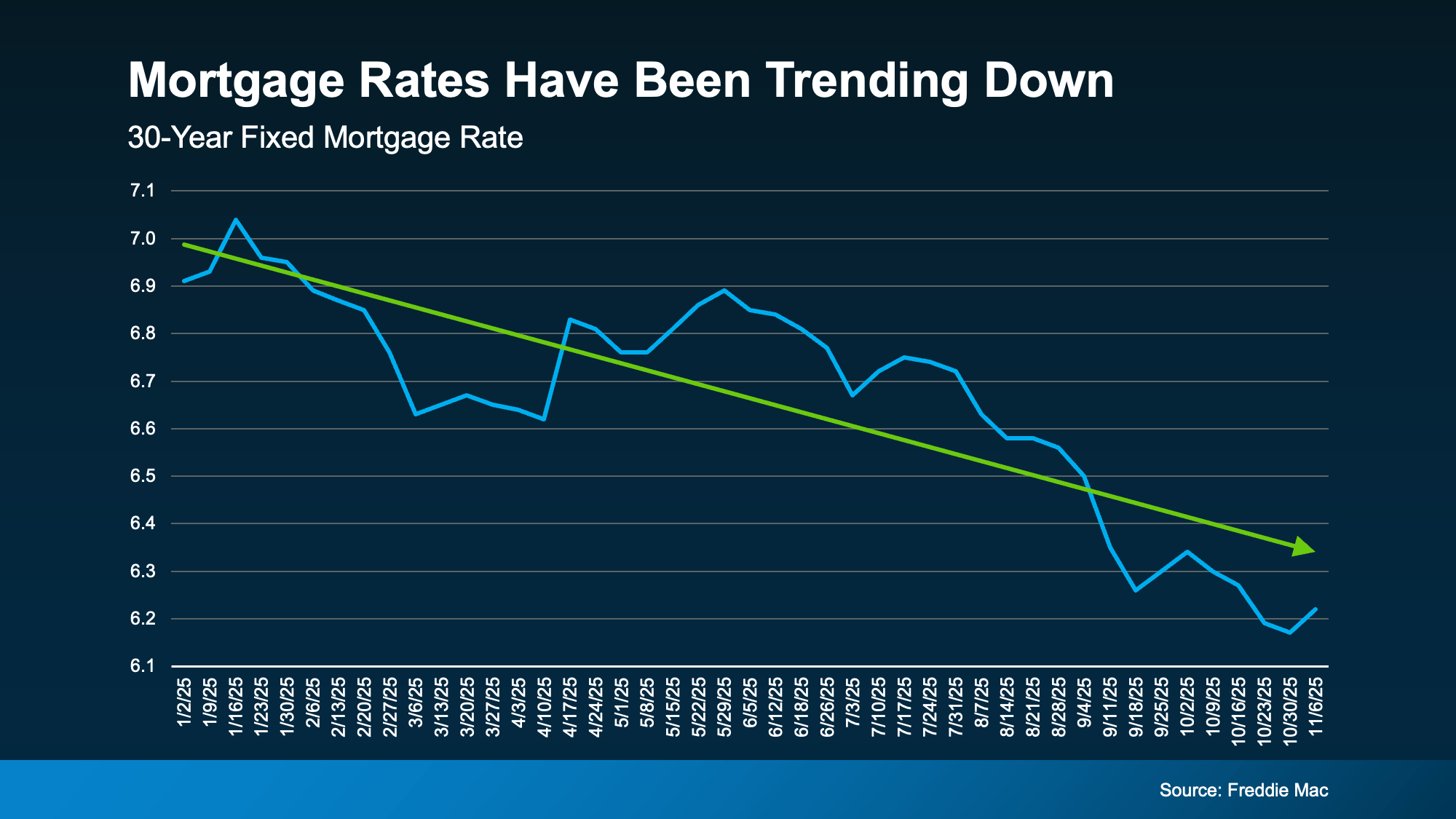

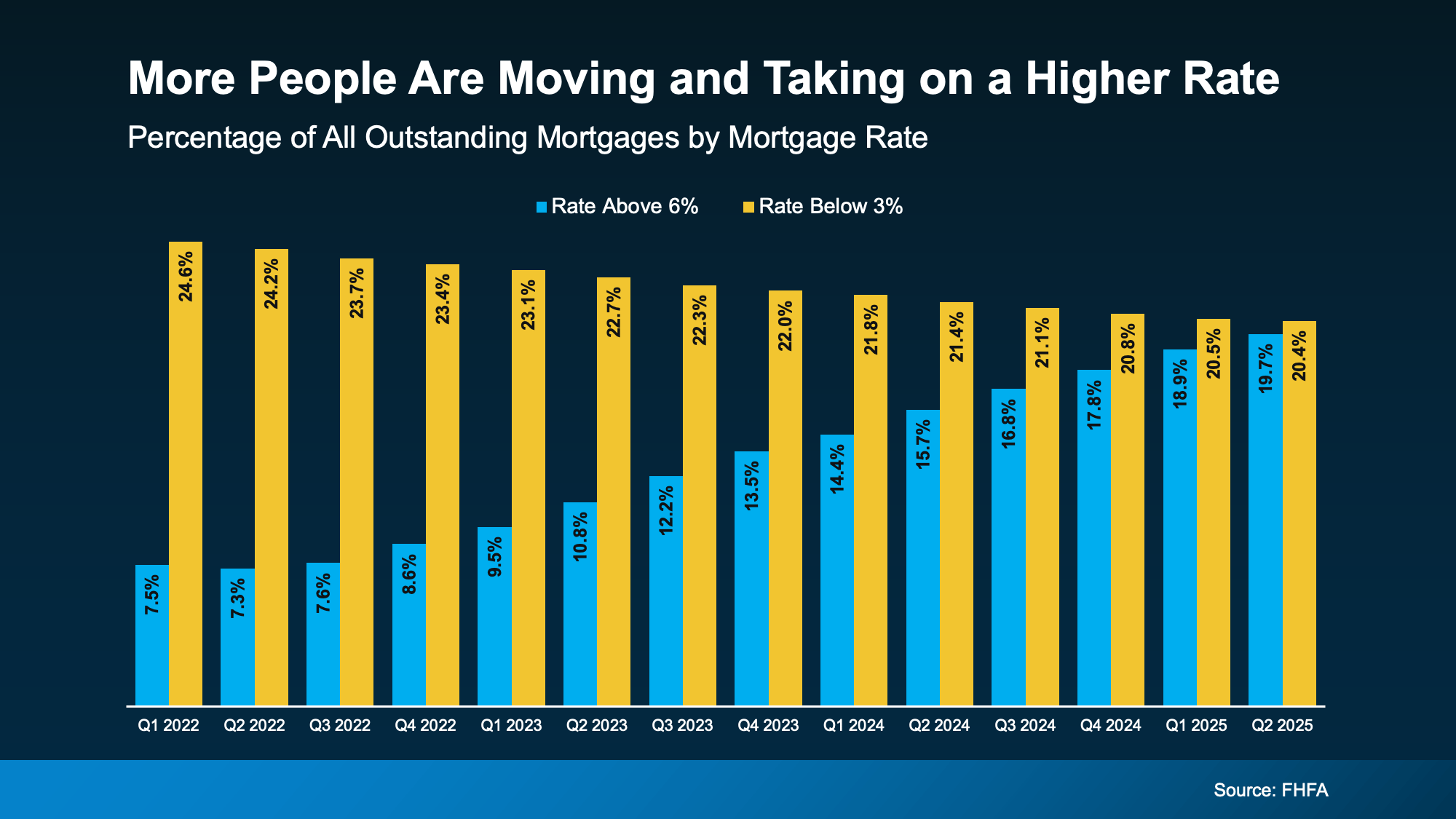

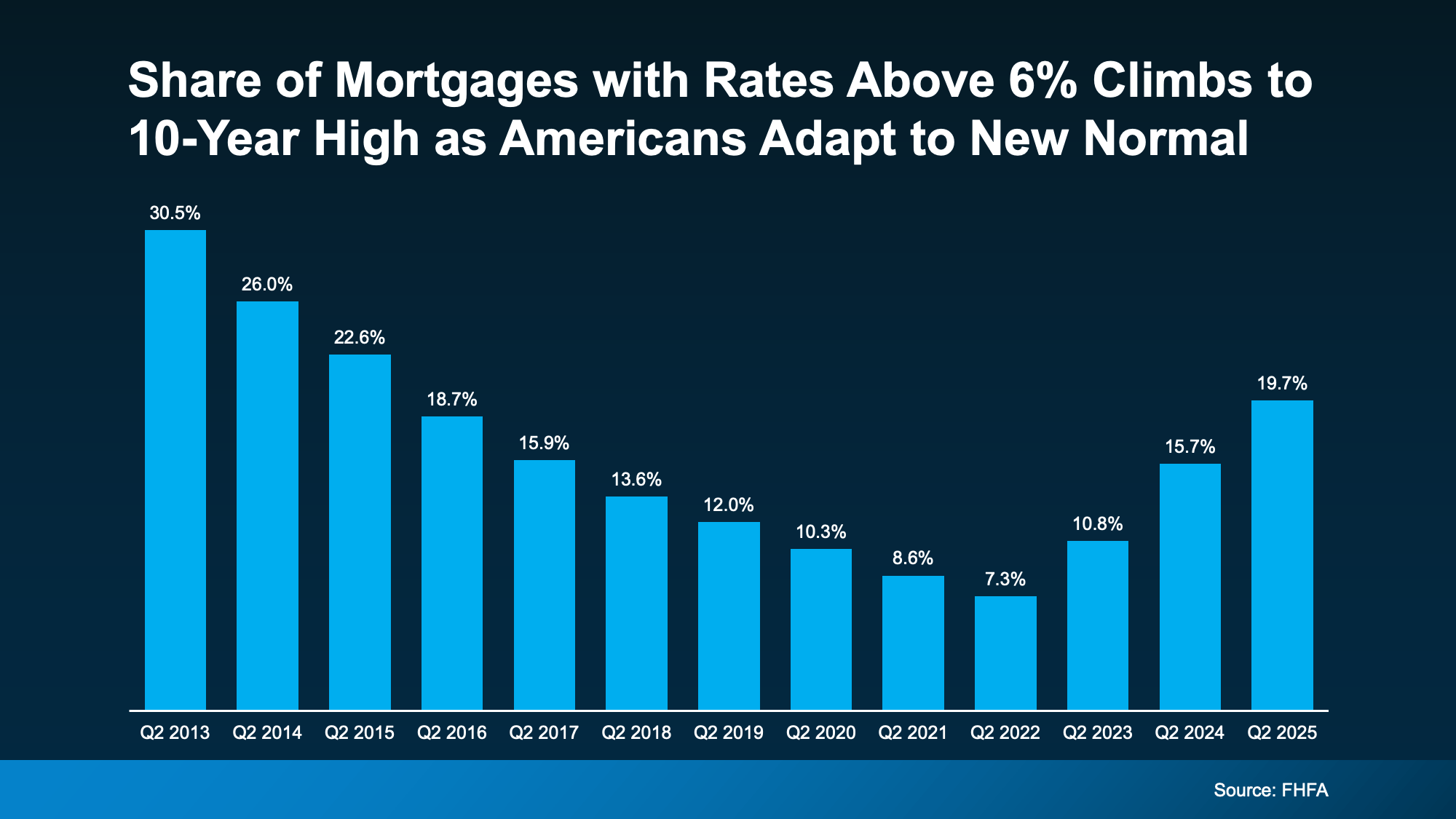

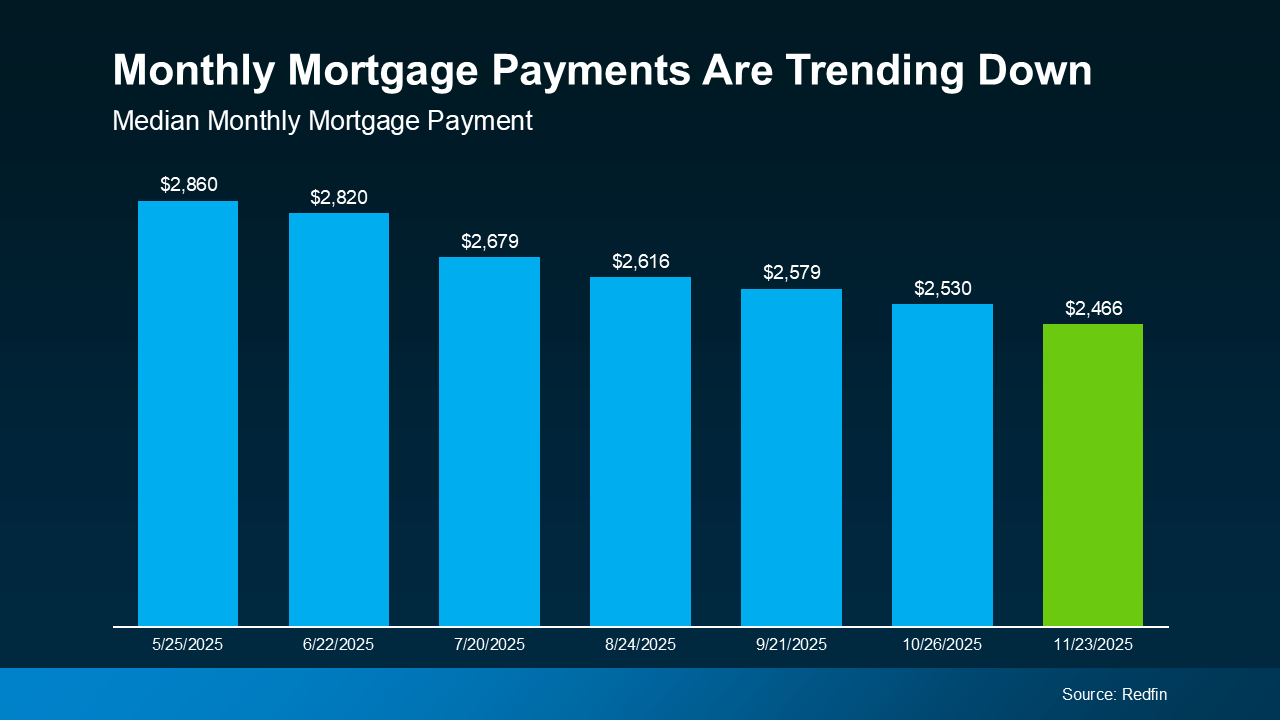

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Zillow sums it up best:

Zillow sums it up best: